New Report: How to Finance Puerto Rico’s Solar Energy Future

Puerto Rico’s transition to a clean and renewable energy future by 2050 will necessitate a complete reconfiguration of its electrical grid and service paradigm. The U.S. territory will need to shift from the current centralized fossil fuel plant generation model with over 35,000 miles of distribution network infrastructure, to a mostly decentralized and distributed system of renewable generation and onsite storage. The portfolio will include rooftop installations, community solar, and utility-scale plants, along with interconnected region-wide microgrids that provide redundancy but can be islanded for resilience.

Estimates of how much solar-plus-storage has to be installed in order to meet the electricity load in Puerto Rico vary significantly, but 12 GW in installed solar and 6 GWh in storage is a reasonable expectation, at an estimated cost of $25-30 billion by 2050. This will represent a 20-fold increase in today’s current level of installed capacity in Puerto Rico.

Given the level of investment required, a key question will be how this massive solar energy buildout will be financed. To tackle this question, IREC has released an updated report, An Assessment of Opportunities and Barriers to Solar Finance in Puerto Rico. Our report, developed in partnership with the Institute for Building Technology and Safety, takes a comprehensive look at the current status of financing for the development of solar-plus-storage across the residential, commercial, industrial, and utility-scale sectors.

Expanding the Role of Cooperativas

Our report highlights how Puerto Rico’s exponential growth in rooftop solar has been accompanied by a robust growth in locally chartered credit unions, called Cooperativas, offering financing alternatives for solar projects. Cooperativas are the financial institutions that communities in Puerto Rico traditionally use for a whole array of financial services. To date, however, most of the solar financing in Puerto Rico has come from U.S.-based solar companies. More than 70% of all financed rooftop installations can be directly attributed to Sunnova’s power purchase agreements, leases, and loan-to-purchase offerings. While important, these solar company financing mechanisms are not always accessible to low-income Puerto Ricans. Building a larger role for the Cooperativas to make solar projects affordable will be a critical next step.

Other important sources of financing include government programs and nonprofit organizations. An important part of the short-term and immediate response to Puerto Rico’s decade’s-old electric utility neglect, exacerbated by hurricanes, floods, and earthquakes, has been philanthropy by U.S.-based and international organizations. The immediate aftermath of Hurricane Maria’s devastating impact on the electrical grid was an injection of tens of millions of dollars to build out energy resilience community hubs and solar-powered emergency shelters and response centers. More recently, federal programs such as the Community Development Block Grant (CDBG) and other U.S. Department of Energy programs have begun to announce funding availability. So far, these programs have targeted lower- and moderate-income residents, small businesses, and underserved communities.

However, no amount of federal and philanthropic largesse will be sufficient to meet Puerto Rico’s resource needs. With 45% of the population under the poverty level, there are over 600,000 households that are in an income bracket of 80% or more below the area mean income. Sustainable financing mechanisms must continue to be developed to reach hundreds of thousands of underserved residents and communities.

A Path Forward for Puerto Rico

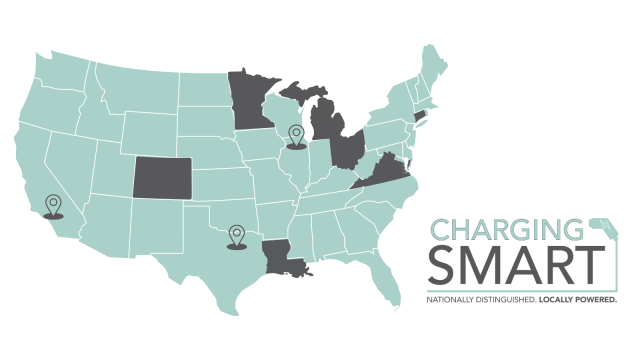

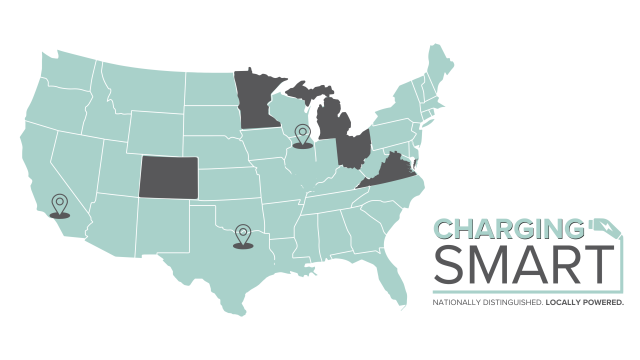

- Fund the Puerto Rico Green Energy Trust. A key question for the future will be how to promote confidence in extending solar financing to the lower and moderate–income sectors of our communities. One of the most significant next steps would be to adequately capitalize the Puerto Rico Green Energy Trust (PR GET). Created under law 17-2019 (the Puerto Rico Energy Public Policy Law), PR GET aims to financially support projects that provide access to green energy to residents of low- and middle-income communities, as well as to strengthen the culture of energy saving and efficient use. Unfortunately, although the government has announced set asides from the Community Development Block Grants, these funds have not yet materialized. When leveraged with private investment, the PR GET would become an equivalent to the green bank movement in 16 different states, which is responsible for an investment of over $7 billion since 2011.

Other key recommendations from our report include::

- Convene different stakeholders to make the establishment and mission setting of finance solutions transparent to a larger sector of the Puerto Rico population.

- Work with the community banking sector (Cooperativas) to establish a reserve fund and guarantee funding mechanisms so that the banking industry can expand its loan offerings to sectors of their customer base that do not meet their traditional lending criteria.

- Work closely with established and successful green banks and trust funds in other jurisdictions such as Connecticut and New York.

IREC is keen on continuing to be a thought and action leader in Puerto Rico’s transition to a 100% renewable energy future. Sustainable solar financing is the most important aspect of the structural scaffolding that must be developed, and we look forward to working with multiple stakeholders to identify and advance solutions.